Bricklayers & Allied Craftworkers Local 1 of Maryland, Virginia & Washington, DC

"Best Hands in the Business Since 1864"

We proudly represent men and women who are skilled in Bricklaying, Stone Masonry, Pointer Cleaning Caulking, Terrazzo Work, and Tile Setting within the construction industry. Our Local consists of two chapters: Baltimore and Washington, DC. The Baltimore Chapter predates the founding of the International Union of Bricklayers and Allied Craftworkers, dating back to March 17, 1864. The Washington, DC Bricklayers Local was chartered by the IUBAC in 1867, while the DC Stone Masons received their BAC Charter on February 1, 1889. Tile Setters and Finishers were assimilated into the BAC in August 1925. In 1994, the International consolidated 18 separate BAC locals from Virginia, Maryland, and DC into one: BAC Local 1, Maryland, Virginia & DC. Our jurisdiction covers Northern Virginia, Washington DC, and the State of Maryland (excluding its three westernmost counties).

Like most organizations, the International and its affiliates, including Local 1 MD, VA & DC, operate under the governance of the International Constitution. Adopted over 150 years ago, our Constitution has been amended numerous times during International Conventions held every five years. The International celebrated its 150th anniversary in October 2015.

Click here to learn more about our history.

Summer Newsletter 2025 – July, August, & September.

Spring Newsletter 2025 – April, May, & June.

Winter Newsletter 2024 January, February, & March.

Events

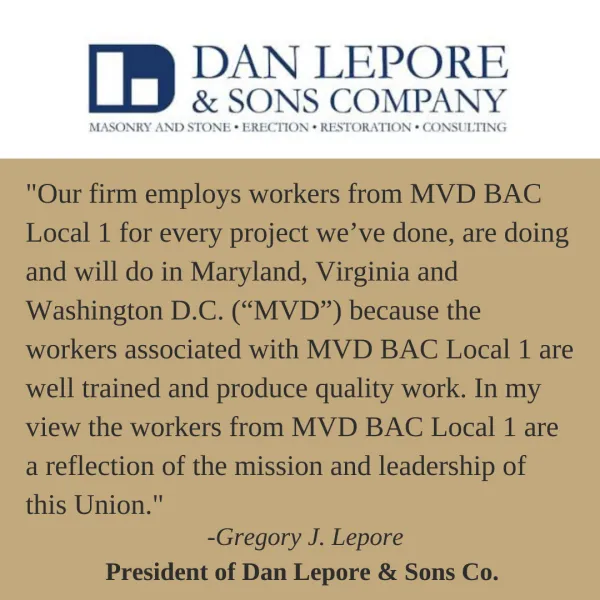

Testimonials

Announcements

American Welding Society Certification Maintenance

Brick & MTT – How To Obtain Your CareFirst Virtual Health Card

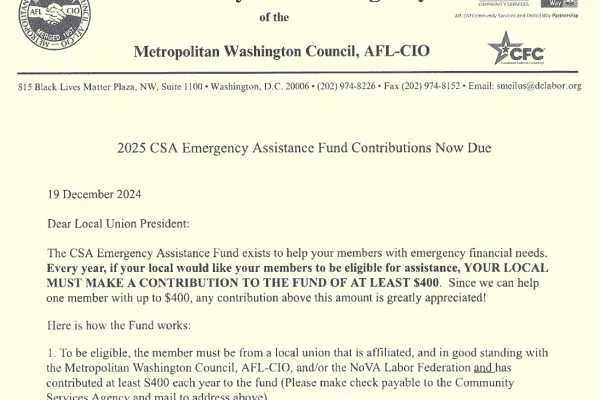

2025 CSA Emergency Assistance Fund Contributions

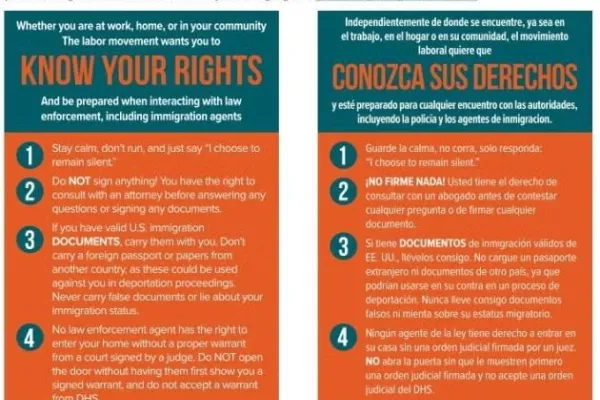

Know Your Rights

Right now, many rights that working families have in this country are under attack. The AFL-CIO has put together a card with important information for all workers to know their rights if detained by law enforcement for any reason, including by immigration agents.

Click here to read, download, and/or print this important information.

(Information provided by The International Union of Bricklayers & Allied Craftworkers)